Why Open Banking API

Future-proof yourself: Unleash unparalled growth, agitily and innovation

Elevate your business to new heights of success by seamlessly integrating Embedded Banking solutions into your customer offerings.

Grow deposits and user base

Reach new segments and deepen presence within target industries and verticals

Benefit from Cost Efficiency

Leverage partnerships and new channels to reduce customer acquisition cost

Faster Innovation

Introduce and iterate on new features, products, and services more rapidly than through traditional banking channels

connectFi: Open Banking Gateway API

A comprehensive, customizable platform offering the full spectrum of functionalities essential for Banking-as-a-Service (BaaS). Equipped with all the tools necessary to efficiently manage and expand your BaaS offerings.

High Throughput

Large scale at low latency. Automatically scales up and down as the load changes.

Single Tenant

Clients independently select and lock onto their preferred connectFi version, ensuring load handling autonomy. Version upgrades occur at their chosen pace.

Top-notch Security

Designed with comprehensive security through ACID principles: encryption, atomicity, consistency, isolation, and durability.

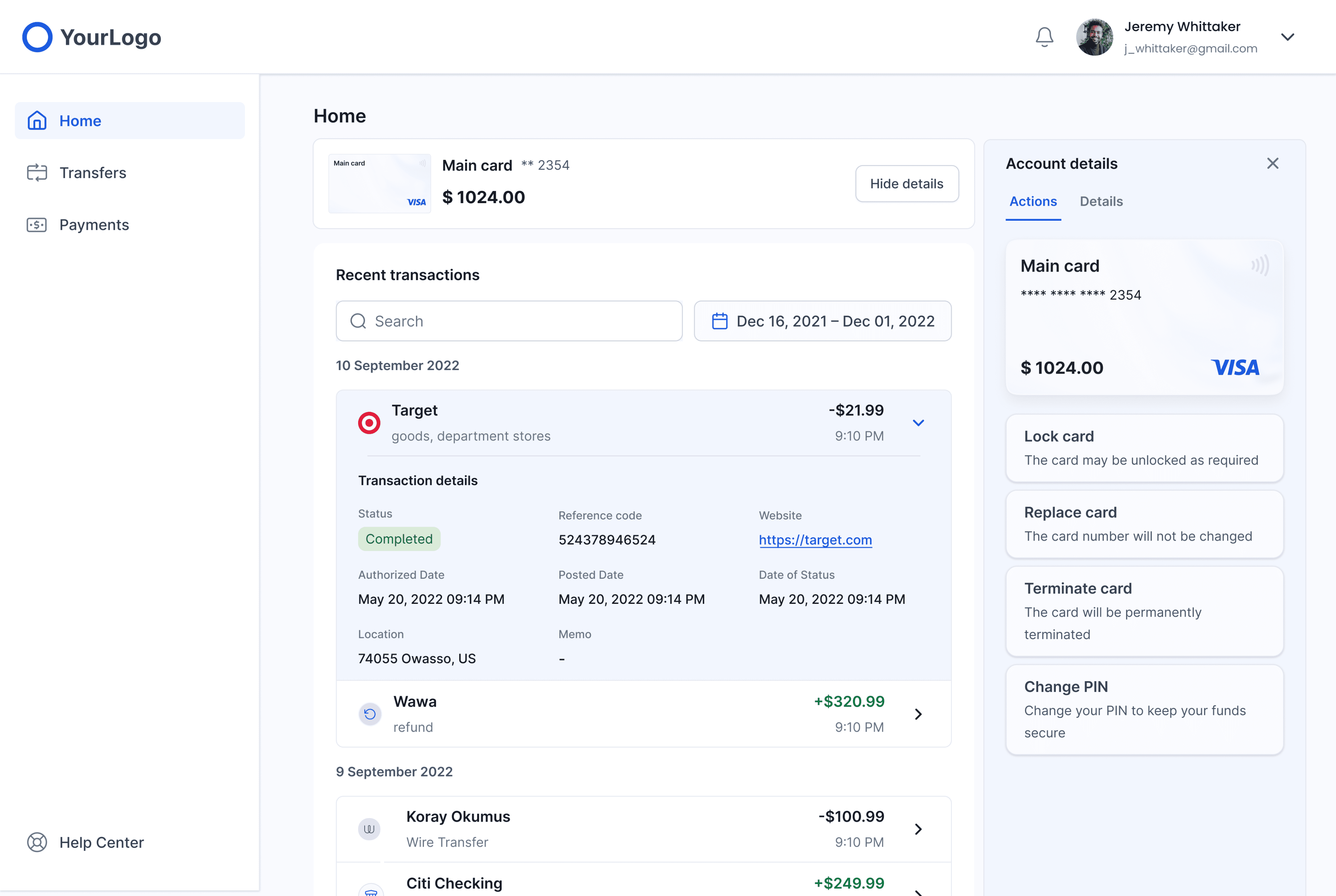

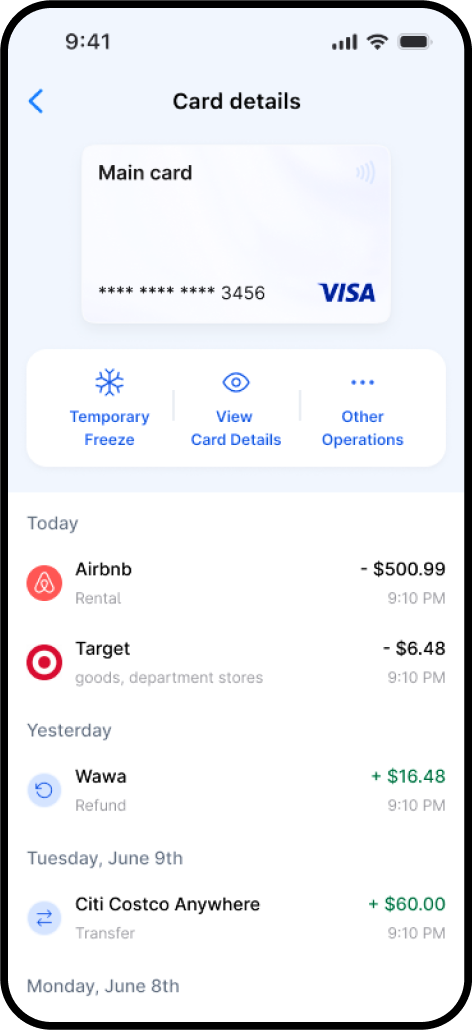

apliFi: Digital Banking Platform

A versatile digital banking platform equipped to run mobile, web, and voice/chat applications. Fully configurable and extensible solution with mobile SDK.

Configurable

Institutions can rapidly develop or enhance solutions using mobile SDKs, incorporating proven, pre-built features to configure personalized products.

Seamless

Businesses can create seamless, secure flow from onboarding to banking to financial management, as well as seamlessly embed banking into their applications.

Fast go to market

A complete out-of-the-box system to go into production extremely fast. Even with customizations, going to market only takes a fraction of the time when compared to other options.

PayGears Advantage

PayGears Advantage

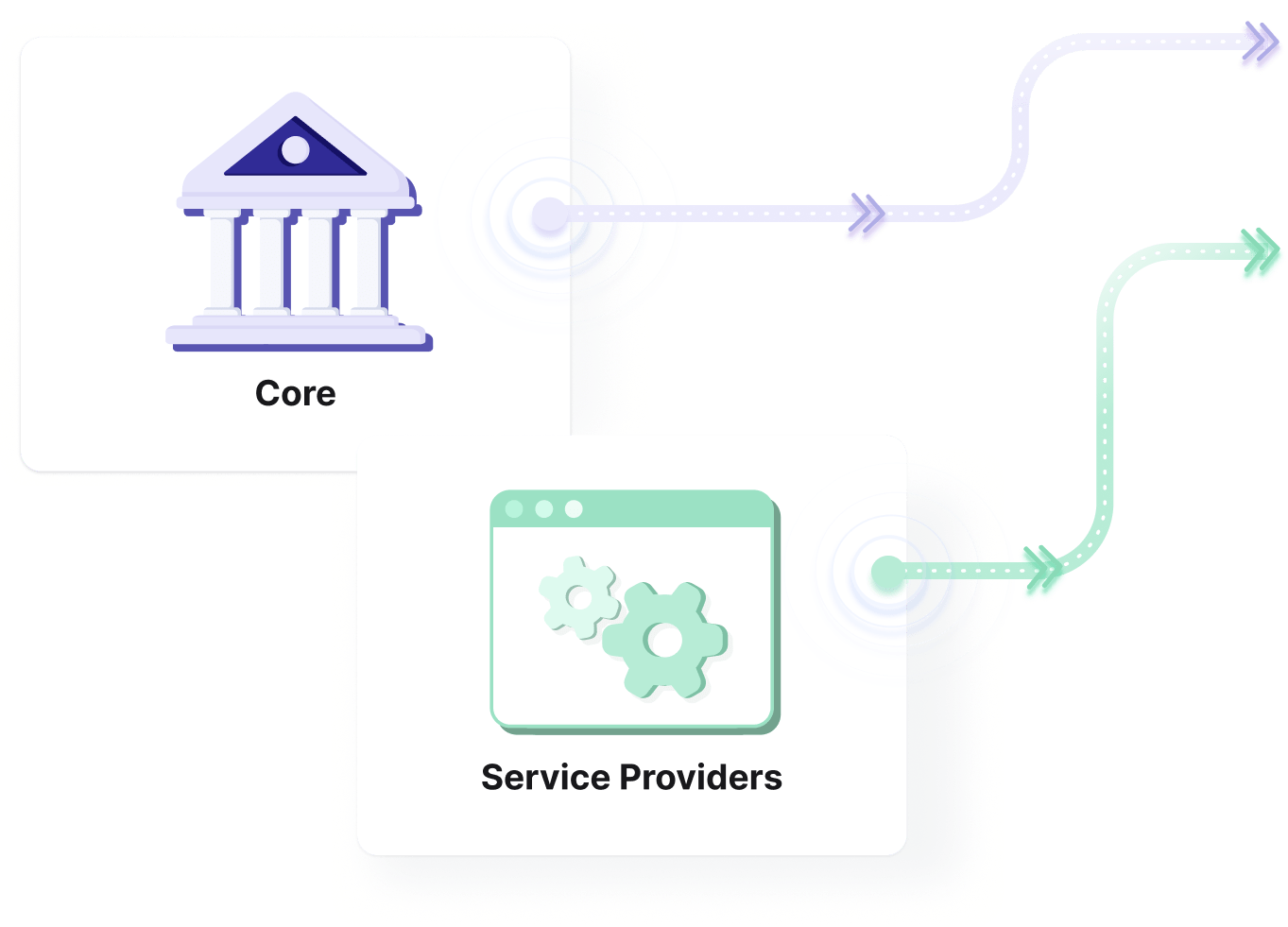

Ready-Built APIs and Tools to Deliver Embedded Experiences

All the benefits at a fraction of the cost

Simplify deployment and eliminate the need for additional resources in developing and maintaining your Open Banking API and partner ecosystems.

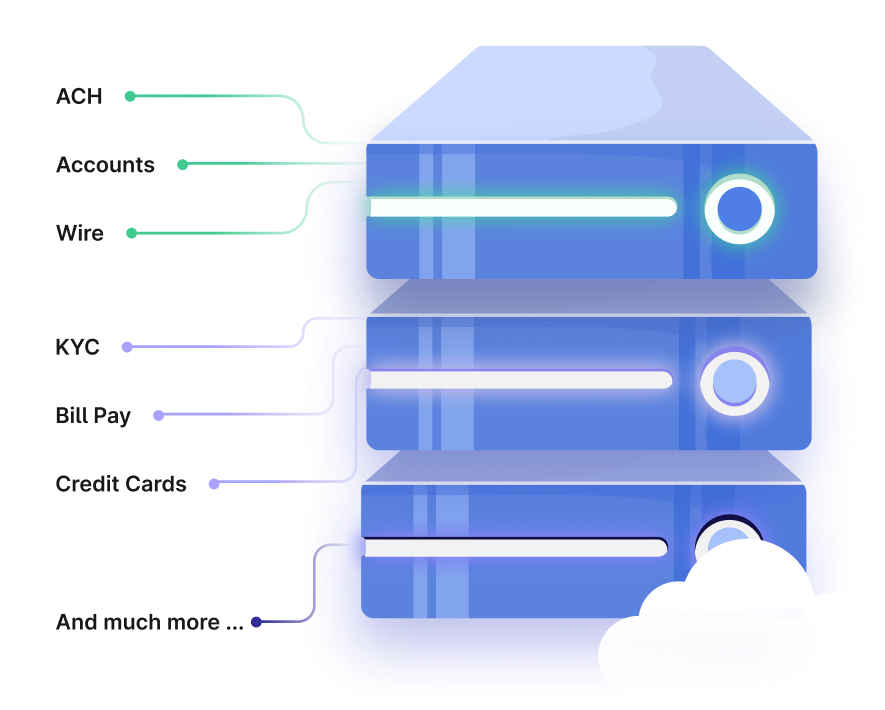

Complete Toolbox

A comprehensive suite of feature-rich APIs, developer tools, SDKs, white-label apps, and out-of-the-box management dashboards to power BaaS or digital banking offerings.

Truly modular

Microservices infrastructure makes our software platform modular and highly flexible, enabling seamless customizations, integrations, and extensions.

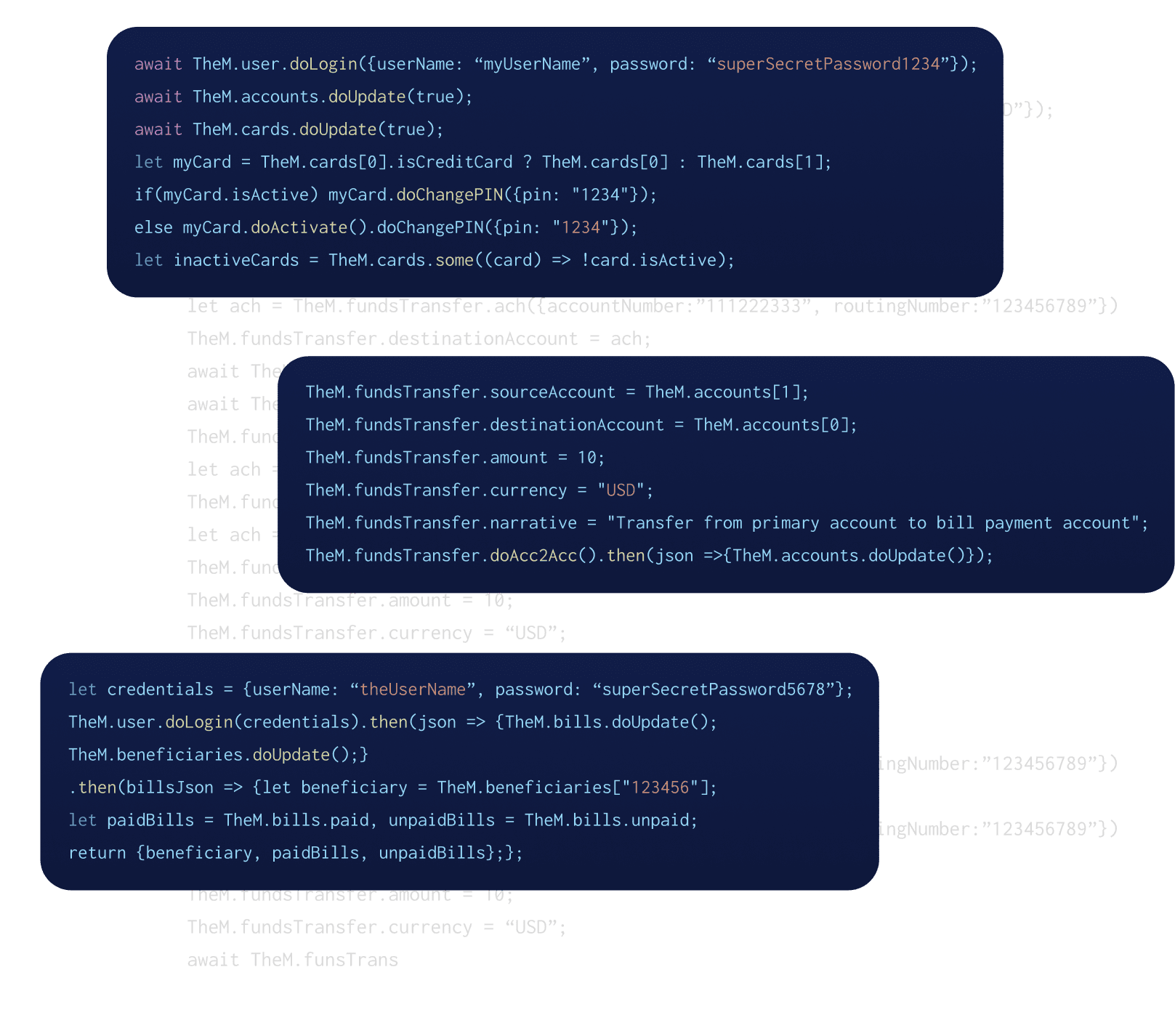

Developers

It's time to build

We’ve simplified integration by building a RESTful JSON API. Deploying your financial products can be fast and simple with PayGear’s powerful APIs, Dashboard, SDKs, and white-label UI.

Read the documentation

Ready to get started?

Contact us to start developing your product and turning your vision into reality.